Irs Schedule 2 2024 – The Internal Revenue Service (IRS) has revealed new income tax rates for the year 2024, with substantial ramifications for taxpayers. This update affects the way individuals and families will be taxed . The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. .

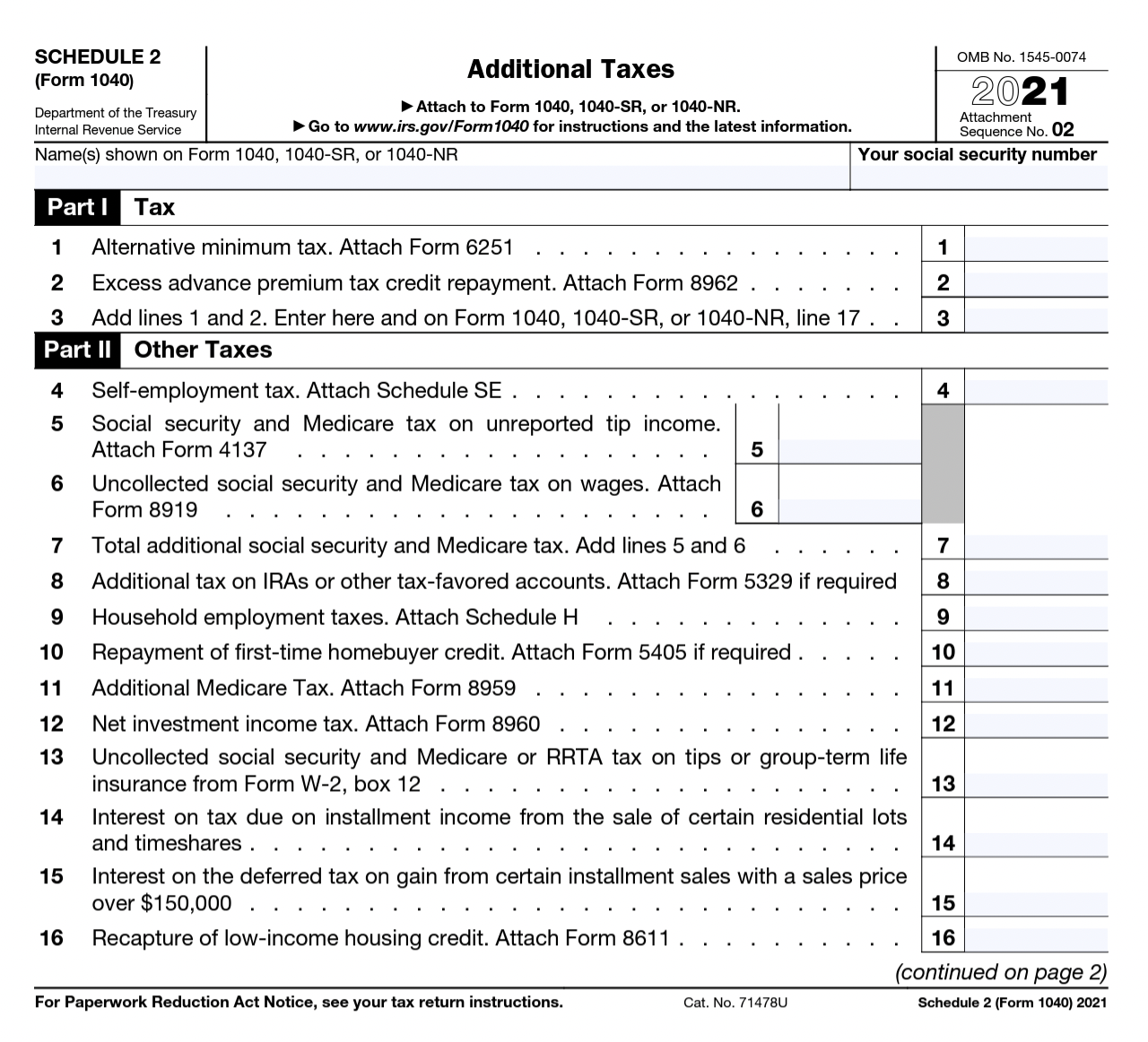

Irs Schedule 2 2024

Source : www.irs.gov

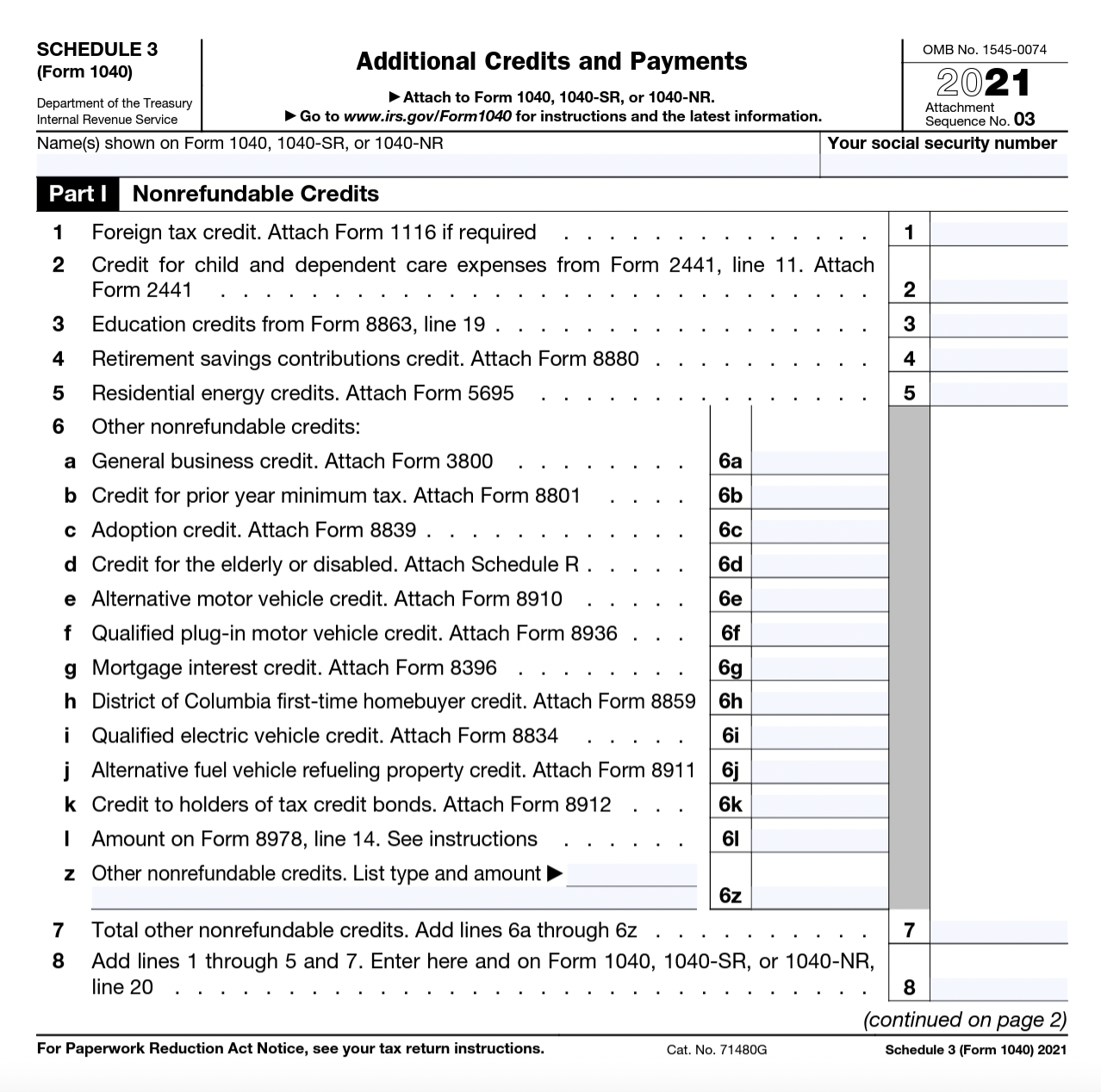

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Concept Tax form of US IRS 1040 with TAX 2024 and refund tax of

Source : www.vecteezy.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

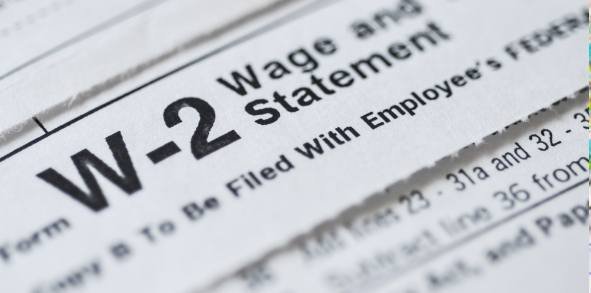

IRS Holds Off on Major Form W 2 Design Changes Until 2024

Source : www.payroll.org

Tax Transcript Decoder: Comparison of 2021 Tax Return and Tax

Source : www.nasfaa.org

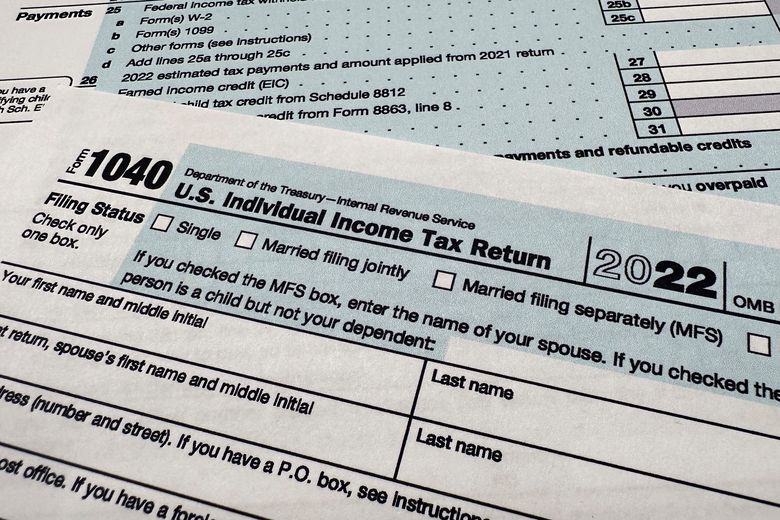

IRS moves forward with free e filing system in pilot program to

Source : www.seattletimes.com

Amazon.com: PassKey Learning Systems EA Review Part 2 Workbook

Source : www.amazon.com

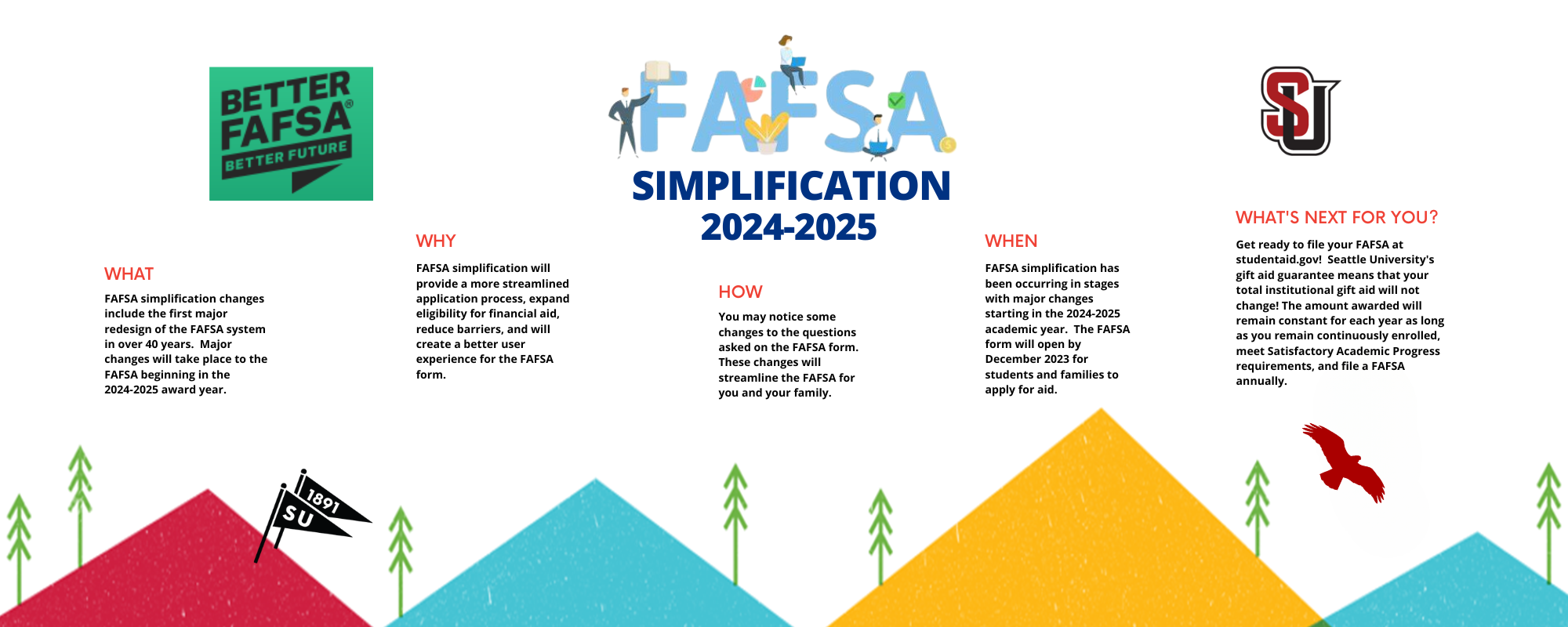

2024 2025 FAFSA Changes | Receiving Financial Aid | Financial Aid

Source : www.seattleu.edu

Irs Schedule 2 2024 Publication 505 (2023), Tax Withholding and Estimated Tax : The IRS revealed updated federal income tax brackets and standard deductions for the upcoming tax year 2024, affecting returns filed in 2025. The adjustments, unveiled on Thursday, showcase . The Internal Revenue Service released its annual inflation adjustments Thursday for the 2024 tax year that will boost paychecks and lower income tax for many Americans. .